Mutual-fund superstar Peter Lynch and author John Rothchild have come out with this amazing book on the stock market. Learn to Earn book explains the basic principles of investing. It gives an insight into the economy, market and capitalization. A high school goer or a person from the non-commerce background can easily understand this book.

- Learn to Earn: A Beginner’s Guide to the Basics of Investing and Business is a book that presents the readers with the fundamentals of business and investing. The book highlights a lot of facts that are not covered in school curricula. About Peter Lynch. Peter Lynch is a stock investor, research consultant, financial author.

- Yet, there is much more to investing than just the principles, and there is much more to Learn to Earn than just the fundamentals. Opportunity comes in many forms, from many sources, with many histories. Brimming with stories and parables, Lynch and Rothchild also explain: Why the world as we know it would collapse without investors.

- Legendary investor Peter Lynch, former manager of Fidelity’s Magellan Fund, gave a lecture on equity investing and the U.S. Economy at the National Press Clu.

Of the many things we’re taught in school, investing and saving is not one of them. The principles of finance are simple and easily grasped. One, Savings = Investment, as over the long term it’s not how much money you make. It’s how much of that money you put to work by saving and investing it. Though it doesn’t hurt to have a high starting point.

Invest Now — Enjoy Later

Learn from Joe Bigbelly’s mistakes:

Bigbelly is 23 — Good 😃 (Young)

Bigbelly works part-time at Wal-Mart — Good 😃 (Stable Job)

Bigbelly lives at home with his parents — Good 😃 (Low Expenses)

Bigbelly saves $2000 down payment on a $20,000 Camaro — Not Good😟 (Not an appreciating Asset)

Bigbelly takes out a car loan for the remaining $18,000 — Not Good 😟

It’s a 5-year loan at 11.67% interest, $400 monthly repayments — Not Good 😟 (Negative Return on Investment)

He forgets all about these payments when he’s driving around in the Camaro and his friends are telling him what a cool car it is. 😟 (Negative Reinforcement)

Over time, there are scratches on the door and stains on the carpet and nobody is “oohing” and “aahing” when the Camaro pulls into the parking lot. It’s just another car, but Bigbelly is stuck with the payments. 😟

To be able to afford the car and a date to ride in the car he works an extra night shift, which means he’s too busy to get many dates.😟

At this point, the Camaro has dents and stains and the engine sounds a bit rough. If he sold the thing he could get maybe $5,000 for it. So what he’s got to show for his $26,000 investment is a $5,000 car that he doesn’t even like anymore.😟

Learn from Sally Cartwheel’s Merit:

Cartwheel is also 23 😃

Cartwheel also lives at home 😃

Cartwheel also works at Wal-Mart 😃

Cartwheel took the $2,000 she’d saved up and bought a used Ford Escort. 😃

Sally actually paid cash for the car, so she didn’t have car payments to make every month. 😃

So instead of sending $400 a month to the finance company, she invested $400 a month in an S&P 500 Index Fund. 😃

Five years later, when Bigbelly was mailing out his last car payment, the value of Cartwheel’s index fund had doubled. Between the doubling of the fund itself and the steady stream of $400 contribution to the fund, Cartwheel has an asset of nearly $30,000. She also has the Escort, which gets her back and forth OK, and she never worries about the dents and stains because she never thought of her car as an investment. It’s only transportation.

As we leave this economic morality comparison, Cartwheel has enough money to make a down payment on her own house/apartment and move out 😃, whilst Bigbelly continues to mooch 😟.

Remember this, over the long term:

An A+ situation is you’re saving and investing a portion of your paycheck.

A C- situation is you’re don’t save and you spend the whole thing.

An F situation is you’re ringing up charges on your credit card and running up a tab, in which case it’s the credit card company that’s making the money on you.

When it comes to debt, it’s ok to pay interest on a house or an apartment, which will increase in value, but not on cars, appliances and groceries.

Pros and Cons of five basic investment methods

Savings accounts, Money-Market Funds, Treasury Bills, and Certificates of Deposit (CDs)

All of the above are known as short-term investments and they pay you interest, whilst you get your money back in a relatively short time.

Short-term investments have one big disadvantage. They pay you a low rate of interest. Right now in many countries, the interest on savings is just over the inflation rate and in some cases, it yields negative returns. So, you’re paying to have your money stored at a bank.

Inflation is when the buying power of your currency goes down, therefore needing more to buy less.

The first goal of saving and investing is to keep ahead of inflation. Professionally, this is generally the lowest benchmark for investors.

The biggest disadvantage of these investments is the taxes you pay on top of the interest you’ve accumulated. So, when putting this all together with rising inflation, stagnant savings & money market rates and paying taxes on top, it’s a definite losing proposition and something you don’t want to be a part of over the long term.

But these accounts have their place, which is being able to access them quickly for paying bills or when you’ve got a big enough pile to invest elsewhere.

2. Collectibles

Collectibles can be anything from antique cars to stamps, NFTs, old coins, baseball, Yu-gi-oh or Pokémon cards. When you invest your money in such things, you are hoping to sell them at a profit in the future. There are two reasons this might happen: The things become more desirable as they get older as there are few in circulation; and inflation of cash raises prices across the board.

Collecting is a very specialized business, and successful collectors are experts not only in the item they collect but also in the market and the prices. So much like anything else, there is a lot to learn and requires a lot of patience.

3. House or Apartments

Buying a house or an apartment is the most profitable purchase most people ever make. A house has two big advantages over other types of investments. You can live in it while you wait for the price to go up, and you buy it on borrowed money. Let’s review the math.

Houses often increase value at the same rate as inflation. Therefore, you’re breaking even. But you don’t pay for the house all at once. Typically, you pay 20% upfront and a bank lends you the other 80%. You pay interest on this mortgage for as long as it takes you to pay back the loan.

As you’re living in this house, you won’t get scared to sell if the housing market crashes, the way you might get scared out of stocks when the stock market has a crash. As long as you stay there the house price on average goes up and you’re only paying any 0–50% marginal taxes on the gains.

If you buy a $100,000 house that increases in value by 3% a year, after the first year it will be worth $103,000. At first glance, you’d say that’s a 3% return, the same as you might get from a saving account or term deposit (CDs). But since you actually only paid $20,000 and borrowed the rest, you’re return is $3,000 on $20,000, therefore, giving you a 15% return.

Along the way, you have to pay interest on the mortgage, but you get a tax break for that and so as long as you pay off the mortgage to you’re increasing your investment in the house. This gets even better if it’s an investment property, where the loan is being paid off by the tenant.

4. Bonds

You’ve probably heard reporters talk about “the bond market”, “Yields rising” and “Rally in the bonds”. But what is a Bond?

A bond is a glorified IOU. Even though it’s called “buying a bond”, when you purchase a bond, you aren’t really buying. You’re simply making a loan.

Basically, a bond is quite similar to the CDs and treasury bills. You buy them for the interest you’ll get, and you know in advance how much interest you’ll be paid and how often and when you’ll get your original investment back.

The longer it takes for bonds to pay off, the greater the risk that inflation will eat up the value of your money before you get it back. That’s why bonds pay a higher rate of interest than short-term alternatives.

There are 3 ways you can hurt by a bond.

The 1st occurs if you sell the bond before the due date, when the issuer of the bond must repay you in full. By selling early, you take your chances in the bond market, where the prices of bonds go up and down daily, the same as stocks. So, if you get out of a bond prematurely, you might get less than you paid for it.

The 2nd occurs when the issuer of the bond goes bankrupt and can’t pay you back. The U.S. government, for example, probably will never go bankrupt. Therefore, the buyers of U.S. government bonds are repaid in full, for the time being.

The biggest risk in owning a bond is the 3rd: inflation. With stocks, over the very long term, you can keep up with inflation. With bonds, you can’t.

5. Stocks

Stocks are likely to be the best investment you’ll ever make, outside of the real estate market. When you buy a bond, you’re only making a loan, but when you invest in a stock, you’re buying a piece of a company.

When people consistently lost money in stocks, it’s not the fault of the stocks. Stocks in general go up and down in value over time. People lose money because they don’t have a plan. They buy at a high, then panic or get impatient, and they sell at a low when the stocks have a correction or a crash.

The rest of this series is devoted to understanding stocks and the companies that issue them. Hopefully, this will lay the groundwork for a lifetime of investing.

A link to the book:

and others by Peter Lynch:

Plus, further readings:

Updated on February 19th, 2018

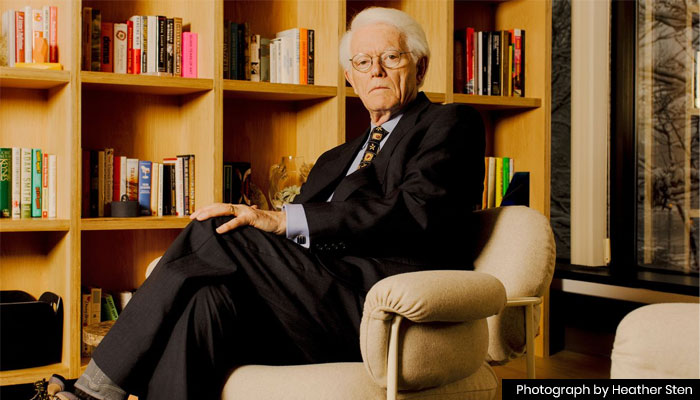

Peter Lynch is one of the most successful institutional investors of all time.

As the portfolio manager of Fidelity Investments’ Magellan Fund between 1977 and 1990, Lynch averaged a 29.2% rate of return. Further, Lynch beat 99.5% of all other mutual funds during the last five years of his tenure.

A 29.2% rate of return is fantastic for a single year, let alone a 13-year period. For context, $1 invested in Lynch’s fund from the beginning would have turned into $28 when he retired 13 years later.

Aside from his fund management responsibilities, Peter Lynch was also passionate about educating people on investing.

His book One Up on Wall Street, where he outlines his belief that individual investors have the ability to beat the performance of professional money managers, has become a favorite among the investment community. Lynch has also authored two other books: Beating the Streetand Learn to Earn.

Despite his illustrious career as both a fund manager and an author, Peter Lynch’s investment philosophy was quite simple and can be summarized into four elements:

- Do your research

- Understand the importance of diversification

- Be patient

- Invest in what you know

Each will be discussed in detail below.

Table of Contents

You can skip to a particular section of this article by using the following table of contents:

Video Analysis

The following video provides a broad overview of Peter Lynch’s investment strategy:

Lesson #1: Do Your Research

Learn To Earn Peter Lynch Book

Investing is a research-heavy endeavor. Peter Lynch recognized this and was a tireless worker during his tenure as the Magellan portfolio manager.

This persistence is well-defined in the quote below.

“The person that turns over the most rocks wins the game. And that’s always been my philosophy.” – Peter Lynch

By ‘turning over’ many rocks and investigating many stocks in different locations and industries, Lynch maximized the probability of finding companies with compelling investment prospects.

This strategy was evident in Lynch’s investing approach. His portfolio employed a wide degree of diversification (more on that later) at both the sector and geography levels. Lynch looked to all areas of the financial markets as a source of investment returns.

Many individual investors might think that this research-based approach is beyond them. It’s one thing to realize that research is an important component of a successful investment philosophy, but it’s another to have the chops to perform the analysis themselves.

This belief stems from the perception that investing is complicated. For evidence of the intricacies of investing, here are 101 financial metrics and ratios that can be implemented in stock analysis. Luckily, not all of those metrics are required to be successful in the markets.

Peter Lynch believed that no one was intellectually incapable of investing in the financial markets. One of Lynch’s most famous quotes describes his perspective on the minimal mathematical ability required to be successful in the markets.

Learn To Earn Peter Lynch Pdf

“Everyone has the brainpower to follow the stock market. If you made it through fifth-grade math, you can do it.” – Peter Lynch

Further, Lynch didn’t just believe that anyone was smart enough to participate. He believed that individual investors can use their personal expertise to outperform institutional money managers.

Lynch recognized that there are many systemic disadvantages to managing large sums of money (including a smaller universe of investable stocks and trade execution concerns) and maintained that smaller investors have an advantage because of this.

Lynch taught that the end goal is to identify high-quality businesses with strong growth prospects. He also placed an emphasis on simple businesses that did not require much technical knowledge to lead.

“Go for a business that any idiot can run – because sooner or later, an idiot probably is going to run it.” – Peter Lynch

At Sure Dividend, we recommend two databases of stocks to identify high-quality businesses: the Dividend Aristocrats and the Dividend Kings. Each is based on consecutive years of dividend increases, which shows that:

- The business is performing well (dividends cannot rise unless earnings do, at least not in the long run)

- The management is shareholder-friendly (or else they would not pay dividends)

The Dividend Aristocrats are a group of S&P 500 companies with 25+ years of consecutive dividend increases.

You can see the list of all 51 Dividend Aristocrats here.

If the Dividend Aristocrats are not exclusive enough, then the Dividend Kings might be more suitable. The Dividend Kings are a group of companies with 50+ years of consecutive dividend increases.

You can see the list of all 19 Dividend Kings here.

By applying a rigorous investment methodology (such as The 8 Rules of Dividend Investing) to groups of high-quality stocks like the Dividend Aristocrats, investors can capture some of the amazing success experience by Peter Lynch at Fidelity.

Lesson #2: Understand the Importance of Diversification

Peter Lynch ran a tremendously diversified stock portfolio. By the end of Lynch’s career, the Magellan fund was known to hold more than 1,000 individual stock positions at any given time.

Besides holding a high number of stocks, Lynch was also diversified by industry. This is not surprising given that he was an investment professional.

More uniquely, Lynch also diversified his portfolio based on the expected earnings growth of the underlying businesses. Namely:

Learn To Earn Peter Lynch Pdf Free Download

- Fast Growers: Companies with expected earnings growth between 20% and 50% (Lynch never invested in companies with 50%+ expected growth rates because he rightly viewed this as unsustainable).

- Stalwarts: Large companies with multi-billion dollar sales and 10% to 20% expected earnings growth.

- Slow Growers: Companies that had expected earnings growth below 10% but paid a healthy dividend.

Lynch believed that stalwarts and slow growers provided stability in Magellan’s portfolio while fast growers were a source of alpha (outperformance over the benchmark).

What differentiates Lynch’s approach to diversification is that he does not buy stocks with less compelling investment prospects just to reduce the volatility of his portfolio.

This practice, which Lynch calls ‘diworseification’, is bound to reduce returns as investors take money that could be invested in their best idea and instead invest it in their nth best idea.

The fact that Lynch owned such a large number of stocks at any one time combined with his strict criterion of only investing in the best stocks is a testament to Lynch’s overall stock-picking abilities.

While individual investors likely cannot commit the time necessary to really know hundreds of stocks, much of the benefits of diversification can be achieved by owning ~20 stocks. This number will reduce risk and improve the chance of buying high-performing stocks.

Lesson #3: Be Patient

Like many other famous investors (Warren Buffett comes to mind), Peter Lynch began investing at a very young age. He famously paid for his graduate studies at the Wharton School of the University of Pennsylvania with the profits from an investment in Flying Tiger.

Lynch describes this experience below.

“So while I was in college I did a little study on the freight industry, the air freight industry. And I looked at this company called Flying Tiger. And I actually put a thousand dollars in it and I remember I thought this air cargo was going to be a thing of the future.” – Peter Lynch

The profits from Flying Tiger were 10x the price of Lynch’s original investment. He would later joke that he attended Wharton on a ‘Flying Tiger Graduate School Fellowship’.

Lynch’s early positive experience in the stock market undoubtedly helped him to develop the skills and interests that propelled his career from that point forward. An early entrance to the stock market also showed Lynch the remarkable powers of compound returns, helping him to invest for the long run over the rest of his career.

“The single greatest edge an investor can have is a long-term orientation.” – Seth Klarman

Investors who invest for the long run have many advantages over those who don’t.

Long-term investing allows for deferred capital gains taxes, lower brokerage commissions, and a better ability to withstand market downturns. All of these factors help to snowball your wealth over time.

Lynch’s long-term orientation helped to boost his performance, particularly during periods of economic recession. When stocks were tanking by ten or twenty percent, Lynch was not concerned because he knew the markets would be higher 5, 10, or 20 years down the road.

“You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets.” – Peter Lynch

The alternative to holding through recessions is selling during recessions. Investors sometimes sell stocks during recessions, hoping to either leave the markets completely or buyback their stock at lower prices.

While a sell and buyback strategy might work some of the time, it is a poor choice in general. Getting scared out of stocks tends to reduce investment returns on average.

“The real key to making money in stocks is not to get scared out of them.” – Peter Lynch

Learn To Earn Peter Lynch Audiobook

Related: The Long-Term Investing Guide to Compounding Wealth

Lynch was also famous for holding stocks whose prices had already risen a great deal since his initial investment. He compared selling his winners to purchase more of his poor performing stocks as similar to ‘pulling out the flowers and watering the weeds’. Thus, Lynch tended to hold stocks for long periods of time if the business’ prospects remained bright, even if the stock’s performance had been fantastic since his purchase.

Learn To Earn Peter Lynch Summary

The performance of individual investors is not measured on a quarterly basis like that of institutional investors. This allows individual investors to invest with a much longer time horizon, which is a key advantage over larger investment funds.

It was also a key contributor to Peter Lynch’s success and a strategy that any individual investor can use to improve investment results.

Lesson #4: Invest In What You Know

Perhaps the biggest lesson that investors can learn from Peter Lynch is to invest in ‘what you know’ – companies for which you have a thorough understanding.

“Never invest in any company before you’ve done the homework on the company’s earnings prospects, financial condition, competitive position, plans for expansion, and so forth.” – Peter Lynch

One of Lynch’s most famous qualities as an investor was his penchant for investing in businesses that he was intimately familiar with – not as a fund manager, but as a consumer. Lynch understood that consumers are the core of the economy, and his investment strategy reflected this.

There are numerous examples of stories where Lynch found fantastic investment opportunities in his day-to-day life. Two examples are:

- Lynch invested in undergarment manufacturer Hanes after his wife expressed satisfaction with their pantyhose. When a new competitor introduced a competing brand of pantyhose, Lynch bought samples of each and brought them to the Fidelity office for his colleagues to judge. When Hanes’ pantyhose was determined to be of higher quality (for a similar price), Lynch’s investment thesis was confirmed.

- Lynch invested in Flying Tiger (which paid for his graduate studies) because he viewed air freight as the transportation of the future. He profited tremendously when the Vietnam War began and the company began transporting troops and supplies to overseas.

While Lynch often got his best ideas from being a consumer himself, he did not blindly invest in these ideas without performing fundamental analysis first. Lynch emphasized that shareholders were business owners.

“Although it’s easy to forget sometimes, a share is not a lottery ticket…it’s part-ownership of a business.” – Peter Lynch

A business owner would not execute an acquisition just because the products were popular. The acquisition would only be completed if a reasonable valuation could be agreed upon, and the business was fundamentally sound. Lynch applied this owner mentality to his investing.

As such, it is not surprising that many of his best-performing investments came from household names. Some of Lynch’s best investments are listed below.

- Ford (F)

- Phillip Morris (PM)

- General Electric (GE)

- Lowe’s (LOW)

Related: Blue Chip Stocks List: 3%+ Yield and 100+ Year Histories

As investors, it’s important to recognize that we are also consumers. This means that we have deep insight into consumer trends – there is nothing stopping us from making observations about the behavior of customers at banks, shoppers at malls, or patrons at restaurants.

By watching what the people around us are buying (or perhaps more importantly, not buying), we can capture some of the investment magic that Peter Lynch demonstrated during his tenure at Fidelity.

Final Thoughts

One of the most helpful things for beginning investors is the ability to learn from the best in the business. Often, high-profile and successful investors are eager to share their perspectives with those willing to listen.

If you are interested in honing your investment skills by reading about other successful institutional investors, the following Sure Dividend articles may be of interest: