- Free Double Entry Accounting Software Uk

- Free Double Entry Accounting Software

- Free Double Entry Accounting Software Download

Double-Entry Software (DES), is an accounting software developed with simplicity in mind. DES is ready for your use immediately, upon installation. It requires less preliminary set-up, account code creation, account grouping, or sub-ledger account. Download accounting and bookkeeping software for small businesses as well as large business full accounting software with double entry system. Easy to manage, track and report on business income, expenditures, and cash flow including sales, receipts.

When you start saving money or think to manage money from personal management then you may face some problem to manage this money. Personal finance is an only solution to manage your money well and double entry accounting system can help to proper accounts with personal finance. There have two systems to maintain your personal finance (1) double entry system (2) Accrual basis. Two systems discussion is given below;

Contents

- 10 Personal Finance Software:

- 11 Performance Calculation:

Double Entry Accounting Basis

When the transactions have occurred accounts effects on two sides and it will equal. One is debit accounts and another is credit accounts. A journal entry has recorded in the first steps in this system. In the journal, entry debit is shows in left side and credit is shown on the right side and both sides are equal. For example, Alex receives cash for selling the goods $ 300. The journal entry is given below;

Cash Dr. 300

Sale Cr. 300

The transitions show that Alex sale goods and increase his cash amount and also increase his assets. On the other hand sales credit and it increases revenue accounts. To journalize the entries then the transactions goes to ledger accounts.

Accrual Basis

There are two types of ways to record your accounts. One is cash basis and two is an accrual basis. You may consider any one of these. The difference is that

Cash accounting recorded the transaction when the money is received or paid. In accrual basis transactions has recorded when the transaction has occurred and earned. For example, I buy a train ticket $ 100 now for traveling my village but I will go after seven days later. In cash basis, the transactions have recorded today when I buy the ticket and in accrual basis, the transaction has occurred when I will travel in train.

Why choose double entry system?

In double entry system transaction has recorded two times in accounting books and it will be equal. There has no chance to theft or fraud. Transactions accountabilities are must in this system and it also worlds wide as well as most popular in the accounting arena. Generally Accepted Accounting Principle (GAAP) is also recommended to double entry system in accounting or bookkeeping.

Types of accounts

Personal finance maintained double entry accounting and it goes to many steps to maintain. In double entry system there has a golden formula which is given below;

This formula shows three accounts assets, liabilities and owners equity but there have another two accounts income and expenses. In short, there have five types of accounts;

- Assets

- Liabilities

- Owners equity

- Income

- Expenses

Assets:

When the owners started the business they make sure capital and other long-term assets to start a business are called assets. There have various types of assets like as long-term assets and short-term assets, tangible assets and intangible assets. In short-term assets consist of cash, bank, the interest of Investments, Accounts receivable, Inventory. Long-term assets are consists of Goodwill, Investments, premises, machinery, furniture and so on.

Liabilities:

Liability is created when you owe money from someone like as an institution, outsides form your business and maybe a bank. There have various types of accounts in liabilities such as long-term liabilities, short-liabilities, accounts payable, notes payable, bonds, debentures, issued shares, preferred stock, stock dividend, capital, net income. Short-term liabilities are consist of accounts payable, salaries payable, notes payable and interest of debentures. Long-term liabilities are consists of issued share, shares capital, bond, debentures, capital, and net income.

Owners Equities:

An owner equity is consists of capital which is brought from owners additional capital, the net profit which is brought from the income statement, the dividend declared. Owner’s equity shows the net worth of equity, strengthen of owners fund and bring it balance sheet in liabilities side.

Income:

When a goods or services sold to clients is bring in a value for the business that is called income. In personal finance, income is increased asset value. For example, company’s works salaries accounts are not valuable for us, but they give us their potentiality and salary statement shows that inflows of value which is given from employees. In the point of views, income increase when assets debited and income show credit. So that when income is credit it will be increased.

Expense:

An expense is an outflow of a business or persons. For example, Alex purchases a computer for his personal use. Here Alex paid cash for computer and its creating expense. Expense increases our liabilities and takes value assets. Expenses decrease assets and increases liabilities. Expense shows debit it is indicated the value of expense increase.

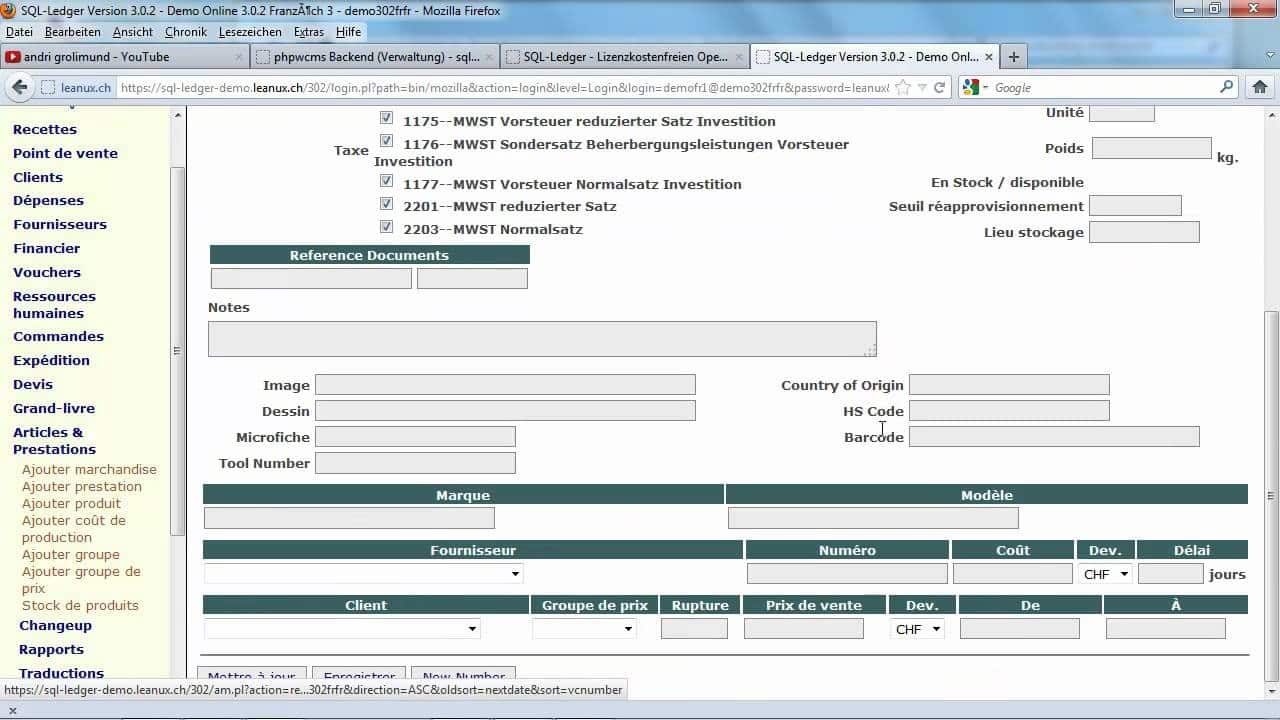

Personal Finance Software:

In the thirteenth century, when double entry accounting system was invented, in that time paperwork or record to the transactions in the written way. On that day’s software is not available and it’s just like a dream. They did not know how to record transactions properly but nowadays we record our transactions in software. The software is a system to format everything and solution to big issues when we reduce our works and labor on its. There are many types of software in an open source or the internet. But we don’t know which one is the best software to fit for your business. I discuss several of software to use your business and I hope you will find your best one.

Money manager EX:

Money manager EX is a great wizard to solve your problem. It’s a simple interface and easy reporting tools. You see that there is a wizard on your hand to guide this process. You can see the following benefits to use this software which is given below;

- Making money transactions so simple with a wizard-based interface and easy reporting tools

- It’s like a hand guide through process

- All kinds of receive and spend money you can add this program

- To Advance amount setting up to adding payee

- Tracking your monetary system (in and out money flow in your business)

- Forecasting budgeting and cash flow features.

- To enough records manually on your database.

- To keep up-to-date on your hand and speeding up your works and saving labor.

Gnu Cash:

Gnu Cash is suitable and flexible software for your personal cash maintenance and projects. If you are using home accounting you will prefer to use Gnu Cash software. Why you use it? Discussing below as a bullet point;

- Gnu Cash is flexible and convenient to the user for its interface.

- Suitable for small business and home accounting

- The guideline is given so that you are setting up easily your accounting process.

- QIF and DX format to import your data.

- To support double entry and tax tools for small business and home finance.

- Data analysis and reporting tools are available

- You can get free financial adviser and also reconciliation tools.

Mvelopes:

Thinking about personal finance, you may think it is so easy but apparently, it will be hard to track your records. Where from money comes and where to go. To success comes first on an initial stage. If you record your transaction well you will succeed. You may appoint an accountant for your transactions which is banks and cash related. If you want to easier and faster you may choose software which one is the best Mvelopes is one of them to use your home finance and small business. Here I discuss the below;

- You can use it mobile or desktop

- It’s an online tool than dedicated programs

- This software is available for free and paid version but the free version has a limitation.

- This software set up your budget and saving plan

- then When you set up this software it needed US phone numbers as well as Us sign up for Mvelopes. Hope you will manage it.

- In the free version, you can use four accounts and 25 envelopes. Envelopes mean categories which are using as spending and income.

Home Bank:

The home bank is one of the finest tools which I ever saw. This tool has lots of benefits to use. Complex and multiple transactions solve using these tools. Home finance and small business you can easily and more comfortable to use. We can discuss below how it is good for our finance;

- To support an unlimited number of accounts.

- Best use for a novice user.

- To solve complex accounts and linked together transfers back and forth.

- Giving templates for easy setup software.

- Easily used for billing and saving no matter how complicated personal finance

- The home bank used high graphics and color to visualized its chats for how spending your money.

- it gives you extra software uses for vehicles which are named “vehicular cost tool” is used for car mileages speed and cost.

The home bank used for in-home finance and it is not advanced financial tools to use but it recovers everything for a novice user.

AceMoney Lite:

AceMoney Lite is free and paid both versions are available for personal finance as well as small business software. Simple interface and doing a complex task so easily. We are discussing AceMoney Lite software;

- To use only two accounts but it will be well enough for many people and the family.

- This software is a great time saver when it will come to all transaction in one place.

- Best use for personal user

- Programming is superb and graphics are excellent in this software.

- Bank transactions are not shown automatically but if you download and add data if your bank is online.

If you want to use more advanced software then you can use it paid version.

Quick Books:

Quick is one of the best software to use home finance and small business. So much authentic simple and easy software is to use. You can use it free and paid version both. Now we can discuss software’s features below;

- Proper Double entry system used.

- Easy setup and client support.

- Easily maintain bank and personal transactions.

- To understand easily and get many statistics and charts to show your real business position.

- Unlimited entries can input in this software.

- Easy to use Windows, Linux, IOS

Money Dance:

Money dance one of the finest software to use home finance. It works money incoming to external sources and internal money flows which are means the bank and other personal sources. We can discuss this software some important features in below;

Free Double Entry Accounting Software Uk

- Money dance connects to the internet all time and gets update real currency convert.

- Easy to use for the user.

- It’s connected with online banks and gets the transaction.

- If the software connects with the net then I will calculate my net assets for depreciation and I will evaluate my net worth easily.

- Using windows, Linux and IOS easily.

If you learn more then click here.

Performance Calculation:

Using software is to be known the health position of personal finance. But we can evaluate it other ways which is so much effective to know the financial position. I am discussing these different systems which we can follow to calculate the performance of home finance. There are three main tools to calculating finance health. These are (1) Balance Sheet (2) Income Statement (3) Cash flow Statement

Balance Sheet:

The balance sheet shows financial position named as assets and liabilities. The position of balance sheet you can meager your financial position. When assets are increased the fixed and fictitious assets will increase and when liabilities increase the long term and short term liabilities, as well as equity, will be increased. The balance sheet tells us the position of assets, liabilities, and equities. Assets and liabilities side is always equal and equilibrium. It makes always in particular date and end of the years. This is the structure of companies or person’s financial position and shows the real scenario.

Income Statement:

The income statement shows your income and expenses comparison. Income shows the right side in ‘T’ form and expense are left side in ‘T’ form. In the modern chart, it shows upper side in income and bottom side in expenses. It gives us how much income receive and outgoing. Income is sales inventory and gains from anything. The expense is salary rent and loss anything. Income statement makes for profit and loss accounts in companies or persons. When income is greater than expenses it shows net profit and expenses are more than income than its net loss. Net profit added in liabilities side as a owners equity and net loss added in assets side in the balance sheet. Income statement makes at the end of the months and shows the profit and loss accounts.

Cash Flow Statement:

Cash flow statement shows that how much money inflows and outflows in your bank and cash accounts. It has two methods (1) direct method (2) Indirect method. Most of the people and organizations maintain indirect method. Cash flow related to net income and when we calculate cash flow we started with net income. It shows cash transactions in cash and bank accounts and also the adjustment in bank accounts. There have three steps to its prepare (1) Operating activities (2) Investing activities and (3) Financial activities.

Free Double Entry Accounting Software

Operating Activities:

Free Double Entry Accounting Software Download

all kinds of income and expense are adjusted in operating activities.

Investing activities:

all kinds of investment whether it is long-term and short-term like as land, machinery and so on which is adjusted with adjustment at the end of the month.

Financial activities:

Financial activates which is occurs in fiscal years and continuities of money flow like as bond issued, issuing share, shares capital and so on and adjusted with the adjustment at the end of particulars date.

These three are preparing in cash flow statement to evaluate money inflow and outflow.

In above discussion of the different method to evaluate health position for home finance but in modern days software is more accurate than the manual system. So that reason, we discussed software for personal finance in the above.